ATTENTION: This Offer Is Exclusively For Non-U.S. Resident LLC Owners with $100k+ Liquid in Digital Bank Accounts. LEAVE THIS PAGE IF THIS IS NOT YOU

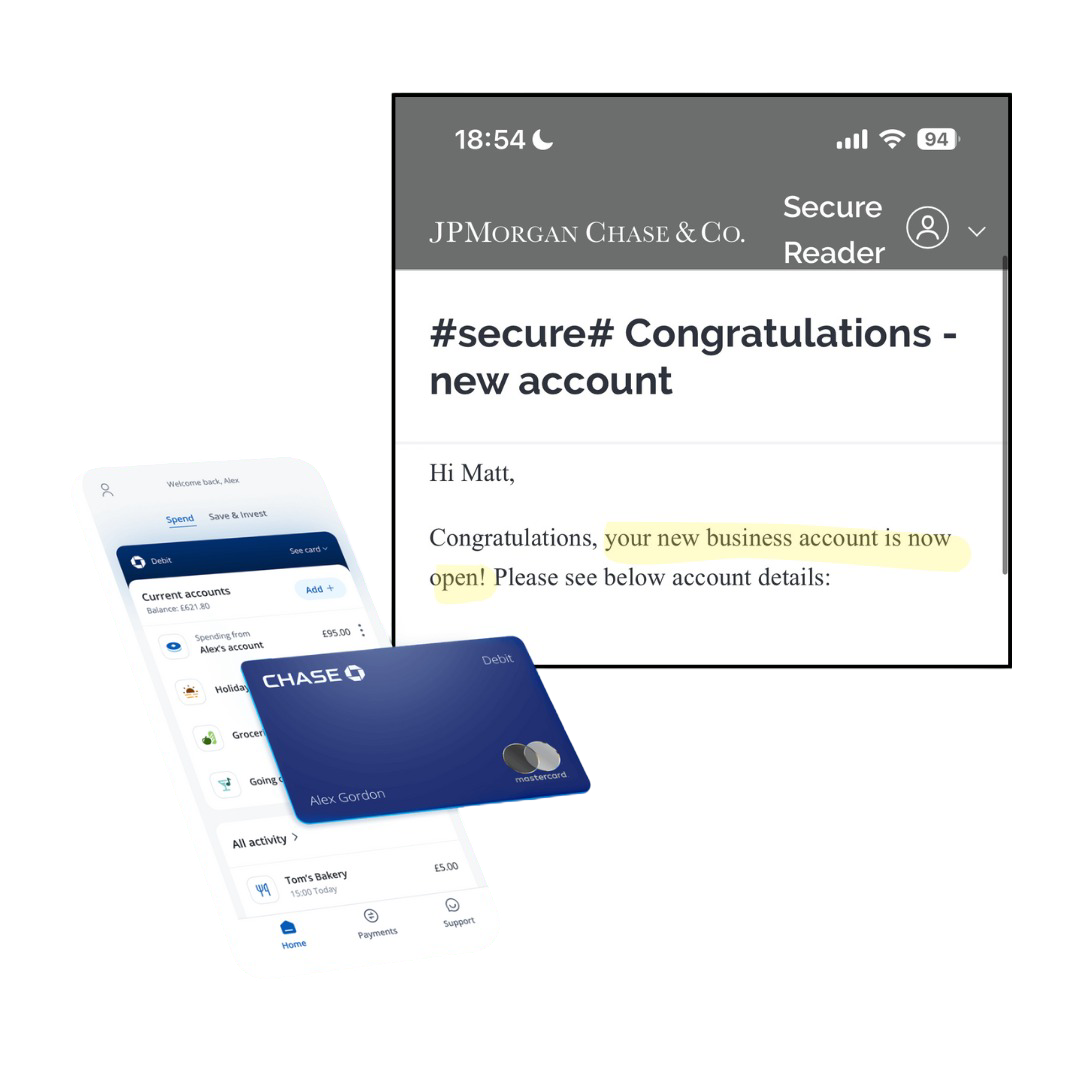

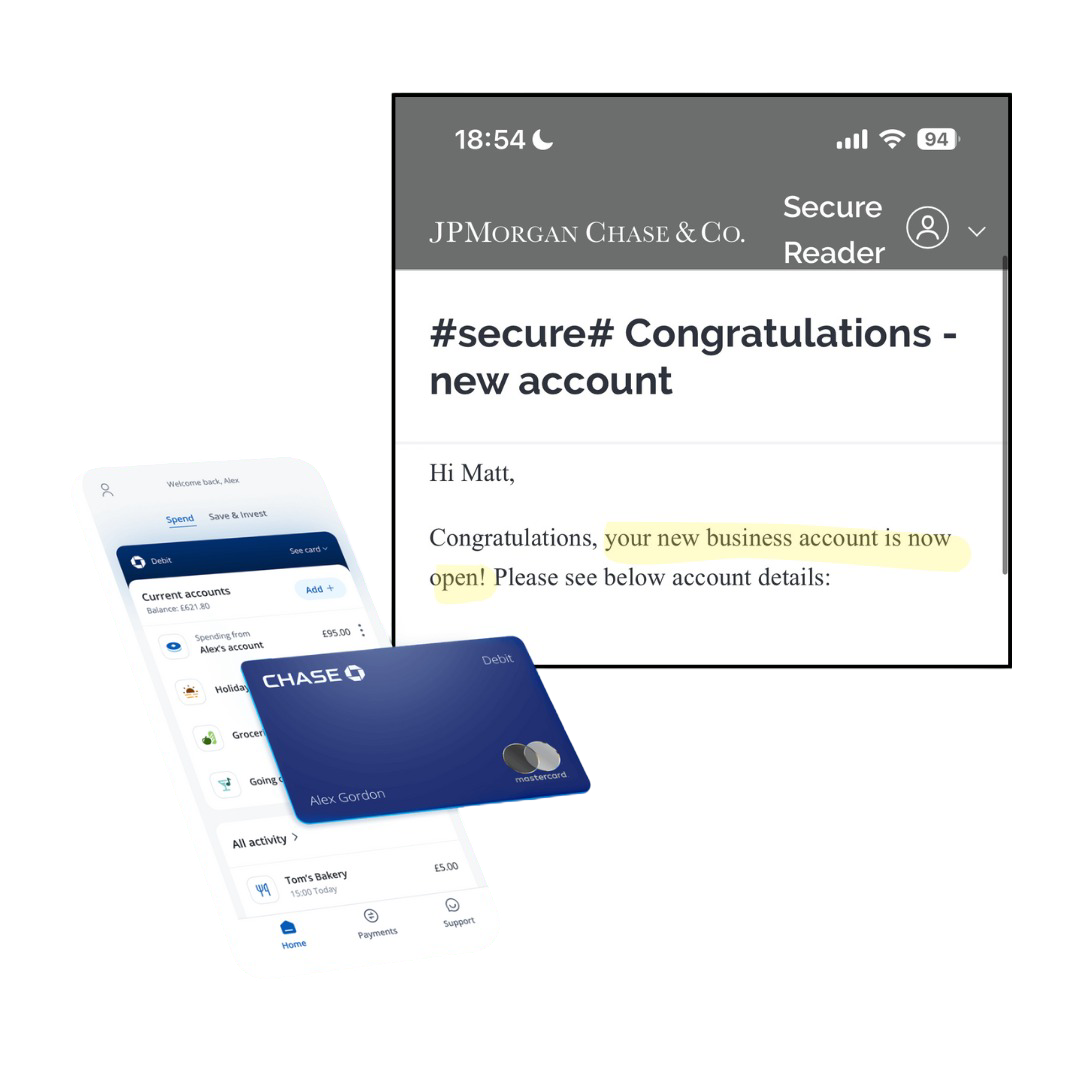

Now You Can Legally Open A J.P. Morgan Chase Business Bank Account Remotely With Just Your EIN—No SSN/ITIN, U.S. Residency, Or Travel Needed. Fully Done For You & Live In 72 Hours

Now You Can Legally Open A J.P. Morgan Chase Business Bank Account Remotely With Just Your EIN—No SSN/ITIN, U.S. Residency, Or Travel Needed. Fully Done For You & Live In 72 Hours

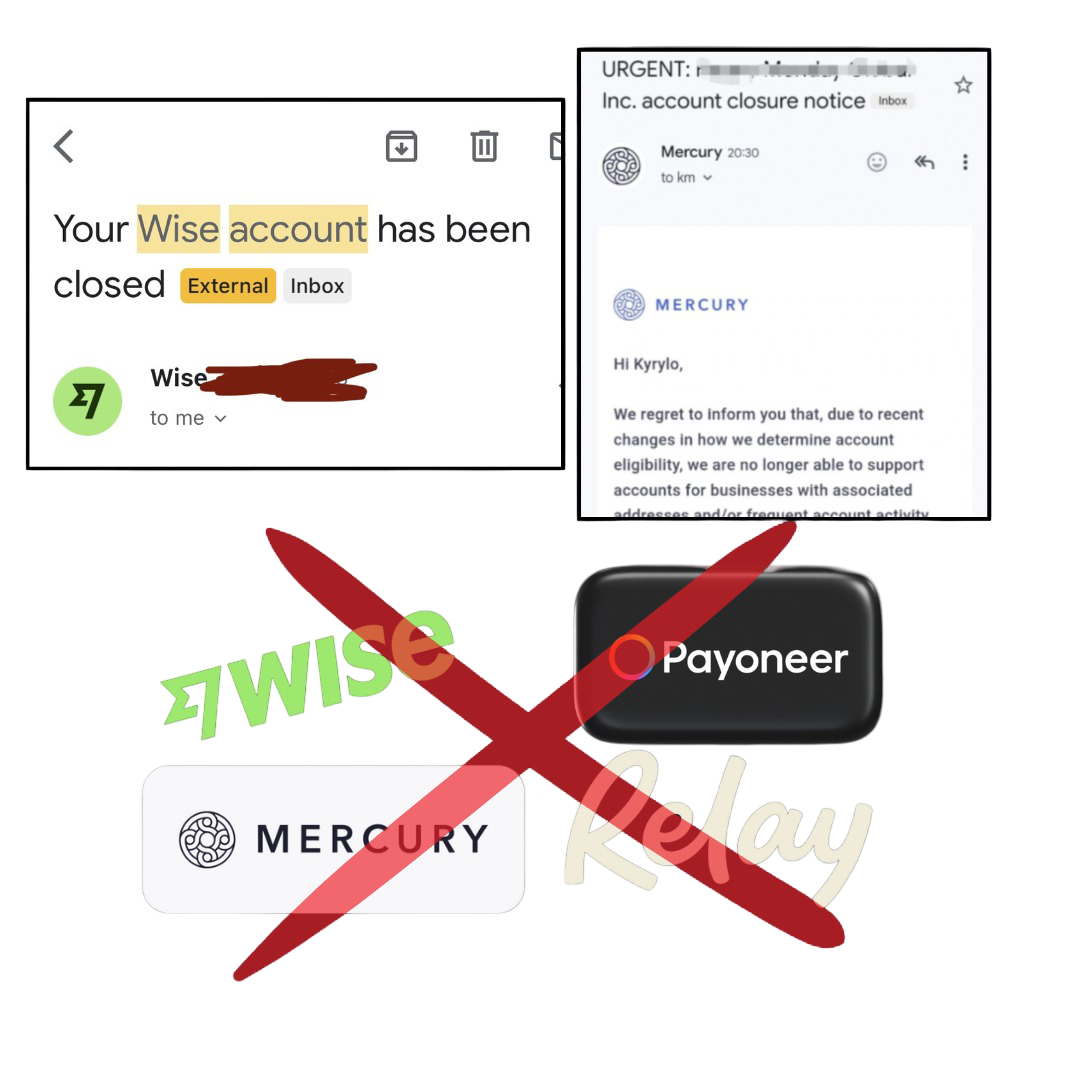

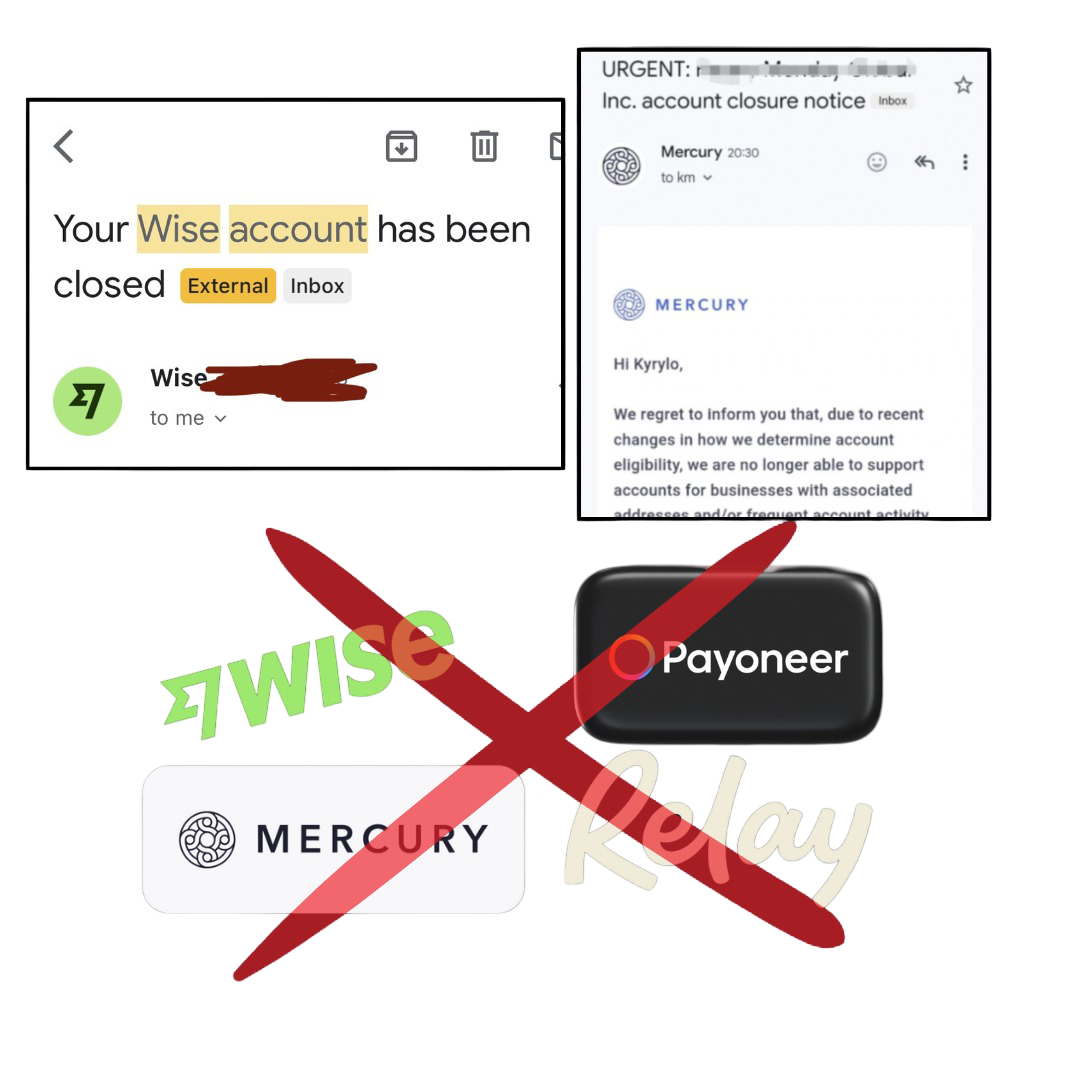

Ditch Wise, Mercury & Digital Banks Before They Lock You Out. Access The World’s Most Powerful Bank With Private Access To A High-Tier Banker—No 'Warming Up' Or Restrictions.

If You Have $100K+ In Your Digital Bank Accounts, Your Money and Your Business Are at Risk.

Here's What You Can Expect Working With Us:

🔓 Unlimited Transactions. Zero Limits.

No volume caps. No barriers. Process as much as you want, whenever you want. You’re finally operating without chains — the way it should be.

💰 100% Money-Back Guarantee — Written Into Your Agreement

If we don’t deliver what we promise, you don’t pay. Period. This isn’t a handshake — it’s contract-backed confidence.

🛡️ No Holds. No Bans. No Reserves. Ever.

Say goodbye to sudden account freezes and nightmare fund delays. You’re in control of your money — not the bank.

🚀 Top-Tier Business Account Status

You’re not playing in the kiddie pool. You’ll be set up at the highest level of banking access, the kind usually reserved for million-dollar clients.

📱 24/7 Priority Support via WhatsApp

Day or night, we’re there. You’ll have a direct line to our team, not some call center. Real support. Real-time.

🏦 Private Banker Access — Inside Chase

Need something done fast? You’ll have a direct connection to a private banker inside Chase who knows your account, your goals, and how to get things done.

💸 No Withdrawal Limits. No Red Tape.

Pull out what you need when you need it. Whether it’s $5K or $500K— no delays, no restrictions, no questions.

Here’s What’s Stopping You from Reaching Your Full Potential

Problem #1:

Fintechs & Digital Banks Were Built to Move Money — Not to Protect It.

Wise. Mercury. Payoneer. Relay...

If you’re using any of these online business banks or fintech platforms...

You’re playing Russian roulette with your own money.

We’ve seen it happen many times (every day i would say)

Account closed, funds frozen. No explanation. No warning.

No one to call. Not even a lawyer can fix it fast.

You either wait 6 to 12 months or go to court.

But here’s the part that no one tells you…

They’re not doing it because of fraud.

They’re not doing it because you’re a “bad business.”

They do it because you’re actually LOANING them money.

They use your cash to fund their expansion.

To get better investor terms. To meet liquidity benchmarks.

And if your transaction pattern doesn’t fit their internal risk model?

They shut you down in a heartbeat and keep the funds.

They were designed to help you send and receive funds fast —not to safeguard serious capital.

These platforms don’t offer true custody, don’t come with federal protection like big banks, and they can freeze or shut down your account

with zero notice or recourse.

Your money isn’t secured. It’s rented.

And when compliance bots don’t like what they see,

Your bag vanishes into a “review queue.”

That’s not banking. That’s babysitting.

And if you're stacking serious capital, you're playing with fire.

Problem #2:

High-Risk Industry, SSN, ITIN, U.S. Address, Proof of Residency... Sound Familiar?

SSN. ITIN. U.S. Address. Proof of Residency.

Everyone tells you to "just open a U.S. business bank account" — but no one gives you the

actual blueprint

So you buy a new LLC, a "virtual address", submit your ITIN (if you have one) maybe use a friend’s lease as “proof"—and” pray it works.

And sometimes it does.

Until one day it doesn’t.

✅ You submitted the docs.

✅ You followed the rules.

✅ You passed KYC.

But then “your account has been flagged and temporarily restricted.”

You’re locked out. No answers. No access to your money. No one to call. No answers to emails.

Why? Because even if you’re compliant, You weren’t set up to look the part. And to the banks, that’s enough to shut you down.

Problem #3:

“You’d have to book a flight to the U.S.—and we’ll assist you in opening your business bank account. ”

Most companies? They hand you a checklist… and wish you luck.

Others? They’ll send you a PDF guide and disappear.

Some go a step further — they give you a “do-it-yourself” template…

While you’re left trying to navigate U.S. banking laws like a maze.

Meanwhile…

You’d have to book a flight to the U.S.—and we’ll assist you in opening your business bank account once you're there.

But here’s the kicker:

They’ll still charge you $3,500–$5,000 for the “privilege”, not including your flight, hotel, food, or the 14-hour plane ride you never wanted to take in the first place.

What makes us so different?

→ Close Bigger Deals — Fast

No more account freezes, flagged wires, or “pending transfers.”

Move like a real dealmaker — with banking that works with you, not against you.

→ Build Unshakeable Trust With Clients & Investors

When you operate through high-tier business banking, people notice.

A real capital structure builds real credibility — and gives you the edge.

→ Protect Your Capital From Being Used Against You

Fintechs like Wise, Mercury, and Payoneer use your money to fund their growth.

They can lock your funds or shut you down without notice.

With Chase JPMorgan, you control the cash — not the other way around.

→ Work With a Real Team—Not an Algorithm

We personally audit, structure, and build your file to qualify for elite-tier banking with Chase, BoA, U.S. Bank & more.

Over 600 entrepreneurs served for funding — we know the playbook that works and we have 60+ banking private relationships

→ 100% Money Back Guaranteed

If we don't deliver, you don't pay. And you get your guarantee without a question asked.

→ Get Access to Private Banker Relationships

Not available to the general public. Not something you Google.

This is relationship-based capital — and we’re the ones who open the door.

→ Fast-Track Approvals—In as Little as 72 Hours

No flights to the U.S.

No 3-month onboarding nightmares.

We do the heavy lifting. You get the green light.

→ We're a Funding Company in the USA, Partnered with 500+ Banks and Lenders

We’ve been in the market for 3 years, helping U.S. business owners get access to 0% interest funding. You can find us on Trustpilot or visit our website for more info and to take a look at our video testimonials.

We’ve now launched a new division inside the company that handles banking solutions for foreign and international individuals just like you.

Our background in the finance industry and our strong network allow for a smooth process and high success rates

Davide Iore (Co-Founder & COO)

Frequently Asked Questions

Who is Bluewater, and what do you do?

Bluewater is a holding company with two primary divisions:

Bluewater Lending: Based in the United States, Bluewater Lending specializes in helping U.S. business owners access business funding with 0% interest or low rates. We focus on offering financial solutions for businesses that need capital to grow, without the burden of high-interest rates typically associated with traditional financing. Our services are tailored for U.S. businesses looking to leverage their SSN and improve their access to flexible funding options.

Bluewater Banking: As part of our international offerings, Bluewater Banking provides banking solutions for overseas entrepreneurs. We assist international clients in opening U.S. business accounts, navigating cross-border financial requirements, and offering remote access to banking services. Bluewater Banking ensures that global entrepreneurs can tap into the U.S. banking system with ease, enabling them to manage their finances, receive payments, and grow their businesses in the U.S.

Together, both divisions of Bluewater work to empower business owners globally by providing customized financial solutions for growth and success.

Bluewater has helped over 600+ US entrepreneurs access business funding and international business owners get access to tailored financial banking solutions remotely.

Where is your team based, and can I see more about your company online?

Our team is fully remote, with members based across the U.S. and Europe, ensuring we have a global reach to serve you efficiently.While our team works remotely, our official company address is located at 402 West Broadway Suite #400, San Diego, CA, 92101 – Emerald Plaza.

We’re available to assist you Monday to Saturday, from 10 AM to 8 PM EST.

You can explore more about our company in our funding division here, where you’ll find real video testimonials from business owners we've successfully helped with their funding needs.

Additionally, you can read authentic customer reviews and testimonials on Trustpilot here

For a closer look at our leadership and the people behind the company, see below for our overhead team of executives.

Do I need an SSN or ITIN to open a business bank account?

No, you do not need a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) if your business is registered as an LLC. However, having one may simplify some processes. But is not required.

Do I have to fly to the USA to open this bank account?

No, you do not need to fly to the USA. We offer remote services to help you open the account without having to visit the US. The process is handled entirely online.

Do I need a US company/LLC?

Yes, you need a US-based LLC in order to open a business bank account in the USA. If you don’t have one, we can assist you in forming an LLC and compiling all the paperwork within 24 hours.

Is this legal?

Yes, absolutely. The banking services we provide to overseas entrepreneurs are fully legal and compliant with U.S. laws and regulations. At Bluewater, we prioritize transparency and full legal compliance. We process credit and debit card payments via secure payment links, and we always require an agreement to be signed that outlines our guarantees. Furthermore, we conduct recorded Zoom meetings with all clients for quality and transparency purposes. You will receive a copy of the meeting, ensuring clear communication and guidance throughout the process. Our company details, including the first and last names of our team members, are publicly available online, providing additional assurance of our legitimacy.

What kind of documentation do I need to provide to open a business account?

Company Verification:

Certificate of LLC formation

EIN (Employee Tax Identification)

US Business phone number

(if you don't have none of them, we'll get it for you included in the service.)

Identity Verification:

ITIN / SSN (only if any - not a must)

Driver’s License (Front copy) or passport

Secondary ID like an ID Card (Front copy ID)

What if I don’t have a US Business address?

You don't need a physical US business address to open a bank account. As part of our service, we will provide you with a legitimate US business address. This address is a professional, real location (not a PO Box), which ensures compliance with banking systems and allows for the receipt of letters and packages, which can then be forwarded to your residential address

Which countries and nationalities are eligible to open a US business bank account remotely?

Most countries worldwide are eligible, including the European Union, Canada, the United Kingdom, Australia, and countries in Asia and South America.

However, some countries that are subject to heavy financial regulations or sanctions, such as North Korea or Iran, Russia and Ukraina may not be eligible.

Nationalities: Entrepreneurs from most nationalities can apply to open a business account remotely, provided they have the necessary documentation (such as a valid passport, ID or Driving License and business registration details).

Is there a minimum deposit or annual revenue requirement for account approval?

Chase Platinum Business Checking

To open this account remotely without an SSN/ITIN, you must deposit a minimum of $100k.

Monthly Fee: $95, which can be waived by maintaining a minimum daily balance of $100,000 in the account

Features:

- 500 free transactions per month, then $0.40 per transaction.

- No fee for wire transfers or ACH payments.

Access to premium services such as private dedicated banking specialists and exclusive business tools.

How do the process and onboarding work?

The process begins with an initial onboarding call, but this is only scheduled once you're ready to commit.

During the call, we will address any questions you may have, explain the full process, collect the payment, and sign the agreement.

Once the agreement (which includes all guarantees) is signed and payment is collected, we will send you an application form to fill out. This will require your existing LLC documentation and ID verification to confirm your authenticity. We then conduct background due diligence to ensure everything is in order.

If needed, we will adjust your documentation or business structure to present your business in the best possible light.

Example: We will first verify that there are no delinquencies or issues in your Secretary of State records. We will also ensure that your business has a legitimate, physical US address — and if you don’t have one, we can provide it for you. Additionally, we’ll check that your business presence is in good standing and that there are no problems with your filing or annual report submissions. If needed, we will help you gather any missing documentation before moving forward with the application.

After that, we will schedule a call with you and our Chase VP Banker. Before the call, we'll send you a tailored PDF document that guides you on how to answer the banker's questions based on your business model and needs.

After the call with the banker, you will receive a DocuSign document, which you will need to sign. Once the agreement is signed, your bank account will be approved and ready within 3-4 days.

Finally, when your approval is received via email, the banker will schedule another call with you to officially welcome you to the bank, walk you through the online banking platform, activate fraud protection, and guide you through the entire process via screen sharing, step-by-step.

How long does it take to open a bank account?

Typically, the process takes anywhere from 72 hours to a few days, depending on the bank's requirements and the completeness of your documentation.

Can I open multiple bank accounts under my same name but for different businesses?

Yes, it is possible to open multiple business accounts under the same name/passport but for different businesses. We can help you set up additional accounts based on your business needs.

Can I access my US bank account from my phone app?

Yes, you can manage your US bank account from anywhere in the world through online banking or mobile apps. Once your account is opened, our Chase banker will schedule a call with you to walk you through the banking online app, activate all necessary fraud protection measures, and ensure you're fully set up. This is a personalized, step-by-step guided process to make sure everything runs smoothly.

Do I get a debit card delivered to my home address?

Yes, once your account is opened, you will receive a debit card delivered to your registered home address. The card will be sent directly from the bank within 4-6 business days, and you'll be able to start using it for transactions once it arrives and is activated. You can connect the card with apple pay, google pay as well.

Is my business account protected against fraud and FDIC secured?

Yes, your business account is protected against fraud with Chase’s robust security measures, including encryption, multi-factor authentication, and real-time fraud monitoring. Any suspicious transactions will be automatically flagged and blocked to prevent unauthorized access.

For large transactions or suspicious activity, the bank will contact you directly within 3-4 minutes via your registered phone number to verify that it’s truly you making the transaction.

Additionally, if you set up recurring payment options in your account, Chase will prompt you for confirmation before processing any payments. Furthermore, your account is FDIC insured, meaning your deposits are covered up to the standard insurance limit of $250,000 per depositor, per insured bank, providing you with added peace of mind.

What's your guarantee?

We offer a standard guarantee that applies to everyone, regardless of their starting situation: If we do not successfully open your business checking account within 30 business days, you will receive a full refund.

This means that if you are not approved at all, you get your money back.

If you are approved after the 30-day period, you will still keep your Chase account, and we will refund your payment.

Additionally, we offer an express 14-day guarantee, which works the same way but is available only to qualified prospects as outlined in the agreement.

Both guarantees are part of our formal agreement and are legally binding.

What’s the cost of your service?

Fill out the prequalification form, and you'll know our price!

Will my US business account accept international wire transfers?

Yes, your US business account with Chase will accept international wire transfers. Chase offers the ability to send and receive wire transfers globally, making it convenient for businesses to conduct international transactions.

What if I don’t get approved for the bank account?

The underwriting process is completed before the final approval. This means our banker will review everything in advance and inform us of any missing documentation or areas that need improvement before we submit your application to the bank. This helps us prevent declines from occurring.

However, if for any reason the bank account is not approved, we will thoroughly investigate the reason for the denial and address any issues that arise. Additionally, if we do not deliver your approved bank account within 30 days, you are eligible for a full refund, no questions asked, as outlined in our agreement.

Do I have to pay taxes with this bank account?

No, simply having a US-based business bank account does not automatically trigger tax obligations. Taxes are based on your business activities and the revenue generated, not the account itself. For most overseas entrepreneurs with a remote LLC, the business may qualify for 0% tax on revenue generated. (that's why is super popular.) However, tax laws can vary depending on your specific situation and jurisdiction.

What is the daily transaction limit for deposits and withdrawals from my bank account?

For a Chase Business Platinum account, the daily transaction limits for deposits and withdrawals can vary based on several factors, such as your account's history, activity, and the specific terms set by the bank.

Typically, for wire transfers or ACH transfers, there may be higher or customizable limits depending on your account setup and business needs. (Can go above $1 million a day in daily transactions)

For ATM withdrawals, the daily limit is typically $1,000, but this can vary depending on the ATM you use.

For deposit and inbound wire, you can easily

However, Chase allows you to withdraw up to $5,000 per day upon request. If you're handling larger volumes of transactions regularly, you may be able to request higher limits or negotiate specific terms based on your business needs. We recommend confirming these details with your Chase banker to ensure your account is set up according to your business requirements.

Helping companies achieve massive scale

through tailored financial solutions Since 2020

© 2025 Bluewater Banking — a division of Bluewater & Bluewater Lending. All Rights Reserved.

NOT FACEBOOK: This site is not a part of the Facebook™ website or Facebook Inc. Additionally, this site is not endorsed by Facebook™ in any way. Facebook™ is a registered trademark of Facebook, Inc.